Previous SOMA.finance Weekly Wrap-up

Issue #112

Market Overview

Last week’s bullish energy was snuffed out by a rise in global tensions as the escalating conflict between Israel and Iran led to a spike in volatility across markets, with risk assets struggling while gold traded near its all-time high.

Issue #112

Market Overview

Last week’s bullish energy was snuffed out by a rise in global tensions as the escalating conflict between Israel and Iran led to a spike in volatility across markets, with risk assets struggling while gold traded near its all-time high.

Any major developments in the cryptocurrency industry have taken a back seat to matters of greater importance on a broader scale, be it the rising specter of war, major economic stimulus payments, interest rate cuts, catastrophic hurricanes, or port worker strikes that threaten supply chain instability.

While most analysts remain bullish on Bitcoin and cryptos headed into year-end, it's hard to deny that the ‘digital gold’ and ‘store of value’ themes took a hit this week as Bitcoin fell nearly 10% since last Friday while altcoins were a sea of red. BTC is highly likely to reach that status at some point in the future, but for now, gold is outshining all assets as it continues to trade within 1% of its all-time high.

After hitting a high of $66,574 last Friday, BTC started showing the effects of rising fears around the conflict in the Middle East over the weekend. After Iran launched its missiles, King Crypto plunged through support after support until finally bouncing off support at $60,000 on Wednesday. Thursday was dominated by consolidation, and Bitcoin closed the daily candle at $60,763.

At the time of writing, Bitcoin trades at $61,140, and the total cryptocurrency market cap stands at $2.12 trillion, a decrease of 2.3% over the past week. The DeFi market cap currently stands at $80.6 billion, with a 24-hour trading volume of $4.57 billion, which is 5.6% of the total crypto market volume.

Crypto News

Crypto Voters – A nationwide and battleground state poll conducted by HarrisX and Consensys shows that 49% of those polled described a candidate’s support of pro-crypto policies as being “extremely” or “somewhat” important to them, further highlighting the growing stature of cryptocurrencies concerning U.S. politics. 56% said they support Donald Trump’s pro-crypto stance, with a third saying they are more likely to vote for him because of it. 54% acknowledged that it’s important for Kamala Harris to take a clear position on crypto, showing that neither party has a monopoly on the issue. Overall, voters were split between trusting Republicans (35%) and Democrats (32%) on setting crypto policies. 92% of crypto owners plan to vote, underscoring their significant impact on the upcoming election.

Tokenization Rising – Blockchain solutions provider Digital Asset announced the completion of another large pilot project demonstrating the tokenization power of its Canton Network, this time working with clearing and settlement service Euroclear, the World Gold Council, and global law firm Clifford Chance to tokenize gold, Eurobonds, and gilts. A total of 27 unnamed market participants participated in the project, including 11 observers, who tokenized assets and used them as collateral in over 500 real-time atomic transactions, divided into six categories. In the project, simulated transaction flows ending in a prime broker default were carried out in a three-day period, representing a simplified workflow and considerable savings of time. The project report estimated that tokenization could save 35%–65% across the settlement value chain, including $4.1 billion from settlement failures.

Real World Use Case – A study from Chainalysis found that stablecoins now account for approximately 43% of the total transaction volume in Sub-Saharan Africa, largely due to currency devaluation. While the region accounted for just 2.7% of global cryptocurrency transactions between July 2023 and June 2024, the smallest of any region, the use cases are “compelling,” with Africans leveraging crypto for business payments, as a hedge against inflation, and for more frequent, smaller (i.e. retail-sized) transfers. “Notably, Sub-Saharan Africa leads the world in DeFi adoption, likely driven in part by a growing need for accessible financial services in a region where only 49% of adults had a bank account as of 2021,” Chainalysis said, adding, “Sub-Saharan Africa is emerging as a global model for how crypto can drive real-world impact, especially in areas underserved by traditional financial systems.”

And in the World of Surprise Developments…

XRP ETF – Cryptocurrency asset manager Bitwise officially filed for the Bitwise XRP ETF, the first spot XRP ETF filing with the U.S. SEC, which, if approved, will provide exposure to the value of XRP held by the trust “less the expenses of the trust’s operations and other liabilities,” the filing reads. In the filing, Bitwise noted that the trust’s XRP holdings will be stored with the Coinbase Custody Trust Company, similar to its other crypto ETFs, and said the trust creates and redeems shares using the cash-create method or in exchange for cash. The ETF filing followed shortly after Bitwise filed for an XRP ETF Trust in Delaware on Oct. 2, signaling that a formal filing with the SEC would follow. The launch of the Bitwise XRP ETP is pending effectiveness of the Form S-1 as well as approval of a Form 19b-4 filing.

Now Taking Bets – A U.S. federal appeals court has greenlighted Kalshi, a derivatives exchange, to list event contracts tied to US election outcomes. This paves the way for election prediction markets—possibly including Web3 platforms such as Polymarket—to operate in the US. The US Court of Appeals for the District of Columbia Circuit ruled against a bid by the CFTC to stop Kalshi from listing derivatives tied to political outcomes on the eve of the US presidential election. “The Commission cannot obtain a stay at this time because it has not demonstrated that it or the public will be irreparably harmed while its appeal is heard,” the judge on the case ruled. As of Wednesday, Polymarket shows that nearly $1 billion has been bet on the outcome of the November US presidential election, showing that, similar to sports, there is a healthy demand for placing bets on the outcome of government elections.

Privacy No More – The Telegram messaging app made waves among the crypto community after announcing a significant update to its privacy policy, informing users that it will start sharing user data with relevant authorities in response to valid legal requests, raising privacy concerns. The development follows the arrest of Telegram CEO Pavel Durov in France, with authorities saying the arrest relates to Durov helping to facilitate illegal activities through Telegram since he resisted sharing user details with law enforcement. In response to the update, Durov noted that “since 2018, Telegram has been able to disclose IP addresses/phone numbers of criminals to authorities, according to our Privacy Policy in most countries.” Moving forward, he said the messaging app will share the IP addresses and phone numbers of users who violate the app’s rules.

Related News

SEC Files Notice of Appeal in Case Against Ripple

Top SEC enforcement official Gurbir S. Grewal steps down

Bitcoin’s ‘digital gold’ status questioned as gold surges and BTC falls

The XRP ETF filing: A sign of regulatory progress or wishful thinking?

North Carolina Bitcoiners set up Hurricane search and rescue operation

Edward Snowden Slams Solana Over ‘Centralization’—And SOL Devs Are Pushing Back

Issue #104

Market Overview

The past week was basically an extended pump and dump for the cryptocurrency market as resistance at $68,000 proved to be too strong for Bitcoin bulls to overcome for the second week in a row, resulting in its price retreating to support at $62,500 and the broader altcoin market following suit.

Talk about the U.S. government's adoption of BTC as a strategic reserve currency provided a boost in momentum, with high-profile figures the likes of Presidential candidates Donald Trump and Robert F. Kennedy Jr. both saying they would make the idea part of their agendas if elected, while Senator Cynthia Lummis (R-WY) sponsored a bill to achieve the goal through Congress.

The fact the U.S. national debt surpassed $35 trillion for the first time in history this week only strengthened the argument as the chart showing the debt has reached the exponential ‘hockey stick’ phase, with no signs of slowing down on the horizon. The Fed held interest rates steady this week, which only exacerbates the matter as the high rate on historically high debt means the U.S. now spends more on interest payments than it does on defense.

Bitcoin spiked to $70,000 on Monday amid the surge in sentiment but reversed course and headed lower as the week progressed. While most markets responded positively to the Fed’s announcement and a signal that an interest rate cut could come in September, Bitcoin continued to slide lower and experienced a sharp sell-off on Thursday, hitting a low of $62,240 before recovering and closing the daily candle at $65,274.

At the time of writing, Bitcoin trades at $64,802, and the total cryptocurrency market cap stands at $2.32 trillion, an increase of 2.52% over the past week. The DeFi market cap currently stands at $92.9 billion with a 24-hour trading volume of $4.7 billion, which is 5.36% of the total crypto market volume.

Crypto News

Strategic Reserve – The crypto rumor mill proved to be correct as Presidential candidate Donald Trump announced plans to make Bitcoin a strategic reserve asset at the Bitcoin 2024 Conference on Saturday, saying that if re-elected, it will be his administration's policy “to KEEP 100% of all the Bitcoin the U.S. government currently holds or acquires in the future,” which would serve “as the core of a strategic national Bitcoin reserve.” Trump also said he would stop the “war on crypto,” fire SEC Chair Gary Gensler “on day one,” and appoint a Bitcoin and crypto presidential advisory council. Following Trump’s speech, Senator Cynthia Lummis (R-WY) announced that she would be introducing the Bitcoin Act of 2024, which, if passed, would establish a strategic Bitcoin reserve that would include a “Bitcoin Purchase Program” of up to 200k BTC per year for five years, for a total of 1 million BTC.

Car Titles Meet Blockchain – The California DMV announced that it is launching its own chain on the Avalanche network and has tokenized 42 million car titles to help modernize the vehicle title transfer experience for the state’s 39 million-plus residents. The DMV partnered with Oxhead Alpha and Avalanche to complete the process, and vehicle owners will be able to claim their digital titles through the DMV’s secure mobile wallet app in minutes using a verifiable credential. Along with providing a more efficient and streamlined experience, the system can also provide an early warning system for lien fraud by creating a transparent and unalterable record of property ownership, making it difficult for fraudulent activity to go undetected. California residents will be able to access their digital car titles starting early next year as the DMV builds out the app and infrastructure for consumer access.

Stable Profits – USDT issuer Tether reported record-breaking profits of $5.2 billion in the first half of 2024 and now holds its largest stockpile of U.S. government bonds to date, with the company’s portfolio worth approximately $97.6 billion. The figures are based on an attestation by BDO, an independent accounting firm. Tether also reported a net equity – which is the total value of all company assets minus liabilities – of $11.9 billion, while the value of the assets composing the company’s Reserves “exceeds the value of the liabilities of the Companies issuing Tether tokens by US$ 5,334,337,355.” In recent months, Tether has worked to expand its portfolio and has made investments into sustainable energy, Bitcoin mining, data, AI infrastructure, P2P telecommunications technology, neurotech, education, and other long-term proprietary investments, which are not considered to be part of its reserves backing USDT.

And in the World of Crypto Laws and Legislation…

Backpedal – A new filing by the U.S. SEC shows the regulator is looking to amend its complaint regarding the “Third Party Crypto Asset Securities” defined in its opposition to Binance’s motion to dismiss – meaning that they are no longer asking the courts to decide on whether the tokens named in a lawsuit against Binance are deemed securities. The tokens in question, which the SEC labeled as securities in its original filing, include BNB, Binance USD (BUSD), Solana (SOL), Cardano (ADA), Polygon (MATIC), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Axie Infinity (AXS), and Coti (COTI). It’s unclear why the SEC has sought to amend the filings, but the move comes as political pressure on the regulator regarding cryptocurrencies is rising amid a pro-crypto pivot by Republican presidential candidate Donald Trump and Independent candidate Robert F. Kennedy Jr.

New Tech, Same Old Fraud – The SEC and the US Attorney’s Office for the Southern District of New York charged BitClout founder Nader Al-Naji with fraud, alleging that he sold $257 million in unregistered securities through the project’s native token, BTCLT, and defrauded investors by siphoning a portion of those funds for personal use. According to the complaint, Al-Naji allegedly spent $7 million in customer funds on luxury items and monetary gifts to family members, including a $1 million gift payment to his wife, despite promising investors that funds would not be used as compensation for any BitClout team members. The SEC also named Decentralized Social (DeSo), a newer project from Al-Naji, in the complaint, along with Al-Naji’s wife, mother, and related business entities, who were identified as relief defendants because they were alleged recipients of investor funds from the BitClout founder.

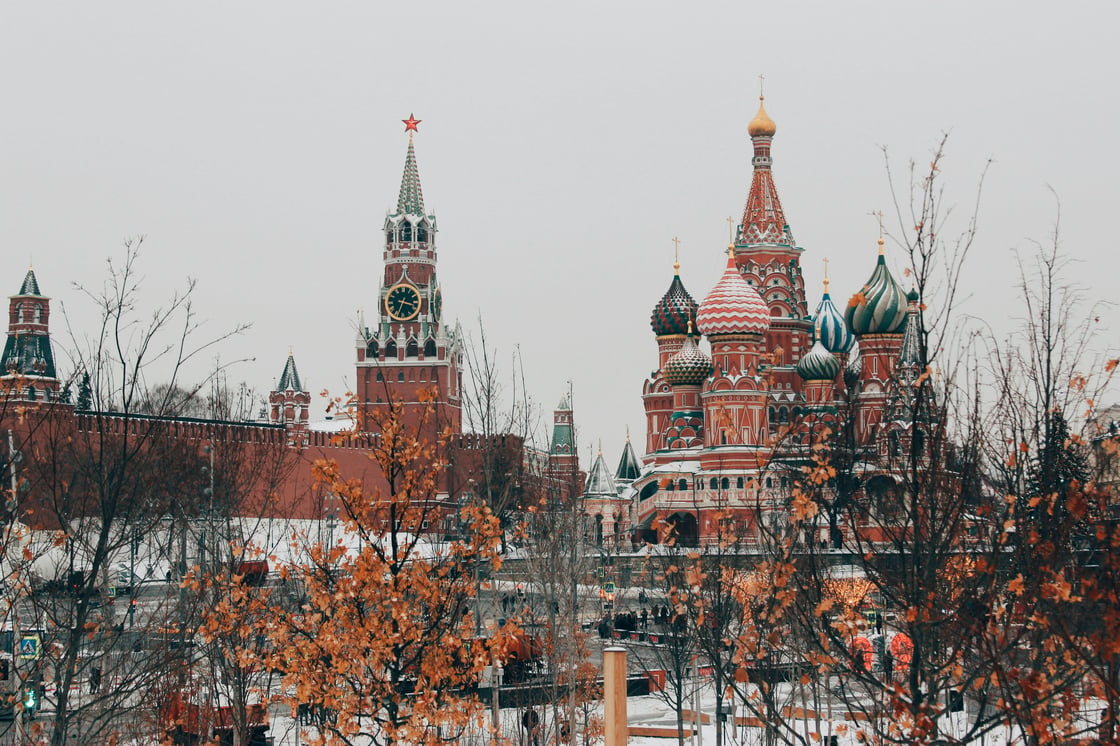

Cross-Border Crypto – Russian lawmakers in the State Duma, the lower hose of parliament, passed a bill on Tuesday that will legalize the use of cryptocurrencies for international trade as part of the country’s efforts to maintain business activities amid heavy sanctions imposed by Western nations following the country’s invasion of Ukraine. The new law is expected to go into effect in September, and the first crypto transactions will take place before the end of the year. They also passed a separate piece of legislation dealing with the regulation of crypto mining. With the Russian economy struggling under the weight of sanctions, it’s anticipated that the draft laws will see quick approval from senators in the Federation Council before being signed into law by President Vladimir Putin, allowing them to come into force on September 1.

Related News

Bitcoin could be a ‘store of value’, says Goldman Sachs CEO

Over 41.5% of Mt. Gox Bitcoin distributed as creditors continue to hodl

Donald Trump selling Bitcoin Sneakers after keynote speech at Bitcoin 2024

US debt surpasses $35 trillion as calls to back the USD with Bitcoin and gold intensify

Lummis Introduces Bitcoin Reserve Bill Aiming to Bolster US's Global Financial Standing

Fed Holds Policy Steady, Expresses More Caution Than Expected on September Rate Cut

Issue #76

Market Overview

The cryptocurrency market entered into consolidation over the past week following months of volatility with an upward trend in the lead-up to last week’s historic launch of the first spot Bitcoin ETFs on the U.S. markets.

Data provided by CoinShares shows that digital asset investment products recorded $1.18 billion worth of inflows last week (subject to T+2 settlement), while ETP trading volumes hit a new record high of $17.5 billion, significantly higher than the 2023 average of $2 billion per week.

While much of the debate leading up to the ETF launches centered around whether it would be a “buy the rumor, sell the news” event, or a “buy the rumor, buy the news” event, so far, both sides appear to have been wrong as it’s turned into a “buy the rumor and then trade sideways” development. Many analysts are still predicting a pullback into the mid to upper $30,000 range for Bitcoin, but it remains to be seen how the price action will unfold.

Representatives from both the Fed and ECB made comments this week suggesting that investors were too optimistic about a rate cut coming in March, which put pressure on financial assets from stocks to crypto. After losing support at $46,000 last Friday, Bitcoin spent the week trading sideways in a range between $40,630 and $43,575, with the majority of the price action occurring near support at $42,700. BTC took a turn for the worse late on Thursday and closed the daily candle at $41,288.

At the time of writing, the total cryptocurrency market cap stands at $1.63 trillion, a decrease of 7.9% over the past week. The DeFi market cap currently stands at $81.6 billion with a 24-hour trading volume of $4.87 billion, which is 7.67% of the total crypto market volume.

Crypto News

Cold Snap – Concerns around Bitcoin mining centralization are on the rise after the network’s hashrate declined by approximately 25% earlier this week due to requests by energy grid regulators in Texas to shut down mining equipment amid plunging temperatures. Global hashrate estimates fell from around 600 EH/s on Friday to 450 EH/s by Tuesday, which coincided with a weather warning for Jan. 14 to 17 issued by the Electric Reliability Council of Texas, which operates as the grid regulator for most of the state. ERCOT’s warning was followed by official conservation appeals on Sunday, Monday, and Tuesday, which forced mining farms in the affected area to turn off their machines. The drop in hashrate indicates that more than four gigawatts of power capacity were curtailed during the shutdown, with the Foundry USA Pool accounting for half of the decline.

Sionara NFTs – NFTs continue to have a rough go as gaming retailer GameStop announced that it will be phasing out its NFT marketplace in February due to regulatory uncertainty. The company notified users that they have roughly two weeks left to access the platform, but assured NFT holders that the decision to shutter the marketplace will not negatively impact their NFTs. Starting on Feb. 2, the ability to buy, sell, or create NFTs on the platform will be removed, which means that NFT holders will need to utilize other platforms to sell their tokens. GameStop cited a lack of regulation as the cause for reducing its crypto services. The firm’s CEO said that while the company remains optimistic about crypto, they did not want to put investor funds at risk.

Reporting Delay – The Internal Revenue Service (IRS) and Treasury Department announced a delay in the implementation of the requirement that businesses in the U.S. report any digital asset transaction over $10,000 in value until the regulators release a clear regulatory framework that lays out the requirements. The new reporting rule, which originally took effect on Jan. 1, was created within the Infrastructure Investment and Jobs Act and established that digital assets are deemed equivalent to cash when it comes to taxpayers who receive payment in crypto through the course of their trade or business. Businesses have been instructed to hold off on reporting such transactions for the time being as the regulators still need to clarify the exact requirements before the rule goes into effect.

And in the World of Cryptocurrency ETFs…

Futures Recall – Asset manager VanEck has announced that it will be shutting down its futures-based Bitcoin ETF less than two years after the product was launched, citing low performance, liquidity, assets under management, and investor interest amid the launch of multiple spot Bitcoin ETFs, including the VanEck Bitcoin Trust (HODL). Shareholders of the Fund have until the market close on January 30 to sell their shares on the Fund’s listing exchange. Those who continue to hold shares to the liquidation date, which is expected to be on or about February 6, 2024, will receive a liquidating distribution of cash in the cash portion of their brokerage accounts equal to the amount of the net asset value of their shares.

ETF Bonanza – U.S.-based ETF issuer ProShares announced that it is working to launch multiple leveraged and inverse Bitcoin ETFs that offer indirect BTC exposure following the launch of the first spot BTC ETFs on local stock exchanges. The new offerings include the ProShares Plus Bitcoin ETF and ProShares Ultra Bitcoin ETF, which seek daily investment results corresponding to a 1.5x and 2x increase from the daily performance of the Bloomberg Galaxy Crypto Index (BGCI). The other three products include the ProShares UltraShort Bitcoin ETF, Proshares Short Bitcoin ETF, and ProShares ShortPlus Bitcoin ETF, which seek daily investment results based on the inverse of the daily performance of the BGCI of -2x, -1x and -1.5x, respectively.

Heavy Flows – The combined volume of the listed spot Bitcoin ETFs surpassed $11 billion during their first four days of trading, a sum that has ETF analysts declaring the products a huge success when compared to the fact that 500 ETFs that were launched in 2023 had a combined volume of $450 million on Tuesday. BalckRock’s IBIT ETF alone process more volume than that, according to Bloomberg Intelligence senior ETF analyst Eric Balchunas. The products offered by Grayscale, BlackRock, and Fidelity account for the majority of the volume, with Grayscale representing more than $5.1 billion of the total as the fund is also grappling with outflows as investors rotate their holdings into ETFs with a better fee structure. At the close of business on Tuesday, the net inflows into all the newly listed ETFs was $894 million, roughly equivalent to 21,000 BTC at a price of $42,600.

Related News

Volume 165: Digital Asset Fund Flows Weekly Report

Electric Capital finds veteran Web3 devs are on the rise

Bitcoin Sees First Ever Weekly 'Golden Cross,' a Bullish Signal to Some

Coinbase argues stocks, Terraform Labs and Howey in 5-hour SEC face-off

Jamie Dimon says he doesn't care about Larry Fink changing his view on bitcoin

Spot Ether ETFs more significant than BTC ETFs for the broader cryptos industry – Analysts

Issue #75

Market Overview

It was a volatile week for the crypto market as the new year saw Bitcoin spike within reaching distance of $46,000, only to reverse course on the 15th anniversary of its ‘genesis’ day and dump back into the trading range that it has been oscillating in since early December.

The anticipated approval of the first spot BTC ETF remains the key driver of market activity, both to the upside and downside, as the competing narratives of multiple approvals versus multiple rejections excited traders and sparked the latest round of FUD – ultimately causing little change in the price of BTC from a higher time frame perspective.

From a macro perspective, the crypto market continues to hold its own amid escalating global conflicts, deteriorating economic conditions, and surging debt levels. The U.S. national debt climbed above $34 trillion for the first time in history and is growing at near exponential levels, further reducing the purchasing power of the U.S. dollar and making the case for reliable stores of value, including gold and Bitcoin.

Late on Monday, Bitcoin’s price started to rally higher, peaking out at $45,930 near midday on Tuesday, its highest price since April 2022. But a report suggesting the SEC would deny the BTC ETF applications hit the market hard on Wednesday, dropping the top crypto to a low of $40,635 before dip buyers arrived to halt the sell-off. BTC recovered back above $43,000 shortly after and closed the Thursday daily candle at $44,200.

At the time of writing, the total cryptocurrency market cap stands at $1.65 trillion, unchanged over the past week. The DeFi market cap currently stands at $88.2 billion with a 24-hour trading volume of $6.9 billion, which is 8.9% of the total crypto market volume.

Crypto News

Cashing Out - Former US President Donald Trump is taking advantage of the recent rise in crypto prices as the wallet affiliated with his NFT sales has transferred 1,075 Ether, worth $2.4 million, to Coinbase over the past month, with most withdrawals coming in batches of 100, 125, and 200 ETH. The Ether was earned through the launch of several NFT collections, including the most recent which featured his infamous mugshot taken when he surrendered himself to authorities in Georgia in August. The balance in the wallet has steadily increased since October and hit a peak of $4 million before the selling commenced.

Tax Crackdown - The Internal Revenue Service (IRS) is set to start enforcing certain aspects of President Joe Biden’s 2021 Infrastructure Investment and Jobs Act, including the requirement that brokers report all digital asset transactions received from crypto exchanges and custody providers that meet or exceed the $10,000 threshold to the tax collector. The new reporting requirement, which was initially scheduled to take effect in January 2023, only applies to businesses handling crypto assets and does not impact individuals. Included in the mandate is the requirement for crypto brokers to collect relevant information, including the sender’s name, address, and social security number, and report the details to the IRS within 15 days from the time of the transaction. Failure to do so could result in a felony charge.

PermaBull – MicroStrategy founder Michael Saylor continues to be one of the biggest Bitcoin bulls as he has begun a four-month process of selling $216 million worth of his shares in MicroStrategy, saying part of the proceeds will be used to buy more BTC. A Jan. 2 filing with the SEC indicates that Saylor has already started selling his 315,000 stock options awards, which were first granted to him in April 2014 and expire on April 30, 2024. “Exercising this option will allow me to address personal obligations as well as acquire additional Bitcoin to my personal account,” Saylor said on MicroStrategy’s earnings call on Nov. 2. A Q-10 filing with the SEC shows that Saylor can sell a maximum of 400,000 shares of his vested options between Jan. 2 and April 26.

And in the World of Bitcoin ETF News...

Dialing up the FUD - Singapore-based crypto platform Matrixport caused a stir in the community after a report from the platform's research arm circulated suggesting that the SEC could reject all the spot Bitcoin ETF applications that have been submitted. The report was widely cited as the reason for the Bitcoin sell-off on Wednesday, but more astute observers said that the move was really just a leverage flush, and the $600 million in liquidations were nothing unusual and part of standard Bitcoin bull market behavior. Matrixport owner Jihan Wu said the widespread dissemination of the report was not planned by the firm and was beyond their control, and stated that he thinks the approval of a spot ETF by the SEC, “which will attract fresh investment into Bitcoin, is inevitable.”

Final Preparations - Attorneys with the SEC met with representatives from the NYSE, Nasdaq, and Cboe exchanges to ask them to revise and finalize their 19b-4 filings, which were submitted by the exchanges on behalf of spot BTC ETF applicants. The meetings were seen as a positive sign that the regulator is nearing approval of some or all of the applications filed as the 19b-4 filings must receive SEC clearance before the ETF can be sold to the public. While no official announcement has been made, sources close to the proceedings say the SEC could begin notifying issuers of approval on Friday with trading beginning as early as next week.

Seeding for the Future - BlackRock, the firm that kicked off the ETF frenzy when it filed its spot BTC ETF application in June, was reportedly expected to purchase $10 million worth of Bitcoin on January 3 as it looked to seed its ETF before launch. It remains unclear whether or not BlackRock made the purchase, and some have speculated that they chose that date as a “tease” since it was the 15th anniversary of the genesis block for Bitcoin. Other reports indicated that the date to purchase was pushed back to Jan. 5, but all reports on the matter are speculative. The SEC’s decision on the ETFs is widely expected to be announced by Jan. 10.

Related News

Bitcoin’s ‘genesis’ block of transaction was created 15 years ago

Bitcoin ETF Looks Very Likely Given These Bureaucratic SEC Steps

Fidelity Bitcoin ETF Set to Trade on CBOE—But No Word From SEC

Bitcoin plunges $3K in just 2 hours on 15th anniversary of genesis day

Bitcoin Ordinals Upgrade Could Create a Centralized Fork, Says BRC-20 Creator

Goldman Sachs may play key role in spot bitcoin ETFs via BlackRock, Grayscale: Report

Issue #74

Market Overview

The return of bull market energy means the return of volatility to the crypto market as the overall picture was mixed over the past week, with Bitcoin (BTC) oscillating between a low of $40,520 and a high of $44,320.

The consolidation by Bitcoin meant traders focused on the altcoin market, with recent gainers correcting lower amid profit-taking and rotation into tokens that had yet to begin their rally. Mini “altcoin seasons” are common during sideways BTC interludes of bull markets, and FOMO reigns supreme as 100x pumpers excite the crypto degens, who hop from coin to coin, oftentimes with little to show for all their activity once all is said and done.

Ongoing discussions and meetings between the Securities and Exchange Commission and various asset managers have analysts growing increasingly confident that a spot BTC ETF will be approved in less than a month. This has put a firm level of support under the market as the majority of Bitcoin holders have no intention of selling anytime soon, which translates to lower liquidity on crypto exchanges, decreasing the likelihood of a rapid, steep sell-off.

After bulls successfully defended an attempt to smash BTC below $40,000 on Monday, they reversed course and pushed its price higher over the next two days, topping out at $44,325 on Wednesday, the same resistance level that had halted the previous two rallies higher. On Thursday, Bitcoin continued to consolidate below $44,000 and closed the daily candle at $43,338.

At the time of writing, the total cryptocurrency market cap stands at $1.66 trillion, an increase of 2.4% over the past week. The DeFi market cap currently stands at $86.9 billion with a 24-hour trading volume of $8.2 billion, which is 12.2% of the total crypto market volume.

Crypto News

Bankruptcy Settlement – The debtors for FTX have reached a settlement with the bankrupt crypto exchange’s liquidators that will see all users who don't have claims pending with the court be reimbursed in U.S. dollars for losses in cash or digital assets that they experienced when the exchange shuttered. Payments will be made based on asset prices at the time that the petitions were filed, “with no differential payments based on post-petition fluctuations in asset prices. NFTs have been exempted from these terms, and eligible claimants will be able to vote on the reimbursement plan in Q2 2024, as long as the agreement receives the approval of the U.S. Bankruptcy Court for the District of Delaware and the Supreme Court of the Bahamas.

CBDCs for Gold – China’s central bank digital currency (CBDC), the digital yuan, has now been used to complete the first-ever cross-border settlement for precious metals using a CBDC in a transaction conducted on Tuesday by the Bank of China's (BoC) Shanghai branch, in cooperation with the Shanghai Gold Exchange. The transaction involved the transfer of 100 million digital yuan ($14 million) in exchange for gold. The BoC Shanghai has been one of the leading supporters of digital yuan pilot testing and previously facilitated the import of iron ore to China via the e-CNY. The bank also partnered with BNP Paribas to launch a digital renminbi project and provides a support system for foreign financial institutions to meet business needs such as digital RMB payment for enterprises.

Cash Redemptions – Multiple asset managers – including BlackRock, ARK Invest, WisdomTree, Invesco, and Galaxy – have filed amendments to their spot Bitcoin ETF applications to allow for the implementation of a cash creation and redemption model, enabling them to accept a cash redemption system rather than in-kind redemptions. These amendments are seen as the latest effort by the investment managers to increase the likelihood that the SEC will approve the first spot BTC ETF by January at the latest as the regulator is purported to cash-only transactions for Bitcoin ETFs. Multiple analysts have said that the applications now have a 99% chance of approval in January following the amendments.

And in the World of Legal Justice...

Extradition Denied – The Appellate Court of Montenegro has canceled the extradition approval of Terraform Labs co-founder Do Kwon to either the United States or South Korea after Kwon’s defense team successfully appealed the previous decision by the High Court of Podgorica that approved the extradition. The court has ruled that the case should now return to the Podgorica Basic Court for retrial, saying the previous decision was affected by a “significant violation of the provisions” of Montenegro’s Criminal Procedure Code. Specifically, the statement from the court said, “[...] Violation is reasonably indicated by the appeal of the defendant's defense attorneys, because the decision does not have reasons for decisive facts, and the reasons given are unclear, which is the reason for its cancellation.”

It’s Official – The U.S. District Court for the Northern District of Illinois has officially entered the order against Binance and its former CEO, Changpeng “CZ” Zhao, that will see Binance pay $2.7 billion and CZ pay $150 million to the Commodity Futures Trading Commission (CFTC). The court approved the previously announced settlement and entered a consent order of permanent injunction, civil monetary penalty, and equitable relief against CZ and his companies Binance Holdings Limited, Binance Holdings (IE) Limited, and Binance (Services) Holdings Limited. As part of the order, CZ and Binance are obligated to make certifications as to the existence, application, and efficacy of Binance’s improved compliance controls, and they are permanently enjoining from further violations as charged.

Commence Sentencing – Judge Lewis Kaplan, the judge overseeing the trial of former FTX CEO Sam Bankman-Fried, denied SBF’s Dec. 20 request for a four- to six-week adjournment of his sentencing hearing. The request would have also delayed his sentencing hearing currently scheduled for March 28, 2024. In their letter to the judge, SBF’s attorneys said the defense needed more time to prepare for the pre-sentencing interview, but Judge Kaplan turned down any attempt to alter Bankman-Fried’s hearing schedule, telling the defense that it did not object to the sentencing date when it was initially set, and Bankman-Fried has already received one extension for filing sentencing submissions.

Related News

Ledger promises to make victims whole after attack

2 risks around Bitcoin ETF launch that no one’s talking about

BlackRock, Nasdaq Meet SEC Again to Discuss Spot Bitcoin ETF

Solana Leapfrogs XRP as Fifth-Largest Crypto, Spurred by Meme Coin Mania

Bitcoin Could Reach $160K in 2024 on the Back of Halving, Spot ETF Hype: Analysts

ISSUE #72

Market Overview

The cryptocurrency market corrected lower over the past week after Bitcoin (BTC) steadily climbed from a price of $27,000 in the middle of October to a yearly high of $45,000 on Dec. 6, an increase of more than 67% in less than two months.

After holding near a price of $44,000 last weekend, Monday opened with a steep sell-off in BTC that saw the top crypto plunge 8.3% to a low of $40,130 before dip buyers put a halt to the slide and bulls gathered reinforcements.

While a rapid 8% sell-off would spell doom and signal greater problems on the horizon for most assets, volatility is a common feature in Bitcoin bull markets, and many analysts took it as a good sign as its price was getting overheated and in need of a correction. On Wednesday, Federal Reserve Chair Jerome Powell emboldened risk-takers by holding interest rates steady and signaling plans for three rate cuts in 2024 as the central bank now expects inflation to fall to 2.4% next year and to drop further to 2.2% by 2025.

Bitcoin responded positively to the interest rate news, climbing from $40,600 to a high of $43,475 late on Wednesday, where bulls looked to establish a firm level of support and continue their push higher. Bears had a different idea, and smacked BTC to a low of $41,440 on Thursday, but bulls fought back and lifted Bitcoin to a daily close above $43,000.

At the time of writing, the total cryptocurrency market cap stands at $1.62 trillion, an increase of 0.6% over the past week. The DeFi market cap currently stands at $80.6 billion with a 24-hour trading volume of $8.25 billion, which is 12.3% of the total crypto market volume.

Crypto News

Threat Alert – The National Vulnerability Database, a repository of cybersecurity risks managed by the U.S. government, has given Bitcoin inscriptions a 5.3 medium base severity score after adding them to the U.S. vulnerability database as part of the Common Vulnerabilities and Exposures (CVE) Assignment list. The agency claimed it was a security flaw that enabled the development of the Ordinals protocol in 2022. A medium score refers to a vulnerability where exploitation provides “very limited” access to a network or denial of service attacks that are quite difficult to execute. This development adds to the ongoing debate within the crypto community about Ordinals, BRC-20s, and the increase in network congestion and transaction cost that has arisen since they launched on the network.

Application Tweaks – In their ongoing quest to launch the first spot BTC ETF, BlackRock revised its application to make it easier for Wall Street banks such as JPMorgan or Goldman Sachs to act as authorized participants (APs) for the fund, letting them circumvent restrictions that prevent them from holding Bitcoin or crypto directly on their balance sheets. The new in-kind redemption “prepay” model will allow them to participate by creating new shares in the fund with cash rather than just cryptocurrencies. Under the revised model, APs would transfer cash to a broker-dealer, which converts it into Bitcoin, before storing it with the ETF’s custody provider. This also helps to shift risk away from APs and place it more in the hands of market makers.

Mug Shot NFTs – Former US President Donald Trump announced the launch of a third nonfungible token (NFT) drop – dubbed “MugShot” – which is centered around the theme of his ongoing criminal indictments. Each NFT is priced at $99 and can be purchased via a credit card or Wrapped Ether (WETH), and they are not transferable until Dec. 31, 2024. Users will be required to complete a KYC check to purchase the NFTs, and anyone who purchases 47 or more digital trading cards can receive “a piece of the president’s ACTUAL suit from his famous mugshot & dinner at Mar-a-Lago with the President.”

And in the World of International Developments

On-chain ID Verification – The Chinese Ministry of Public Security announced plans to roll out a new blockchain-based platform called RealDID to verify the real-name identities of its citizens. The platform has multiple use cases, including personal real name confirmation, personal data encrypted protection and certification, private logins, business identities, personal identification certificate services, and information vouchers on personal identity. The Chinese Government planned the project and will allow citizens to register and log into online portals anonymously using DID addresses, ensuring that transactions and data remain private between individuals and businesses. No official rollout date has been provided, but the agency said the platform holds “huge potential” in guaranteeing personal privacy.

Volcano Bonds Approved – El Salvador’s Volcano Bonds, the country’s highly-anticipated Bitcoin bonds, have reportedly received regulatory approval from the Digital Assets Commission and are scheduled to launch in early 2024, according to The National Bitcoin Office (ONBTC). Discussions about the launch of Volcano Bonds first arose in November 2021, and El Salvador passed the landmark legislation providing the legal framework for the Bitcoin-backed bond on Jan. 11 of this year. The bond is intended to pay down sovereign debt and fund the construction of the country’s proposed “Bitcoin City.” The ONBTC said the bond will be issued on the Bitfinex Securities Platform, a trading site for blockchain-based equities and bonds registered in El Salvador, and will last 10 years and pay 6.5% in annual return to holders.

International Expansion – Coinbase continues to expand its operations to users outside the U.S. as the exchange announced that institutional investors on its international exchange can now access spot crypto trading services for Bitcoin and Ether against USDC. The exchange said the services would launch on Dec. 14 with the goal of building liquidity, and will later expand to include retail investors, additional tokens, and “features that enable new trading strategies and enhance capital efficiency.” The move comes as Coinbase is looking to increase its international presence amid a lawsuit filed by the SEC in June which accuses the firm of allegedly operating as an unregistered securities exchange, broker, and clearing agency.

Related News

JPMorgan says ether will likely outperform bitcoin next year

Bitcoin Above $42K Again as Fed Holds Interest Rates Steady

CFTC Pushes FTX-Inspired Rule to Protect Customers' Money

Binance says the SEC can’t use DOJ plea deals as proof of guilt

Bitcoin to surge to $80K as stablecoins overtake Visa in 2024: Bitwise

The SEC continues meeting with bitcoin ETF hopefuls. Here’s what they’re discussing

ISSUE #70

Market Overview

There was little change in the macro picture for the cryptocurrency market over the past week as Bitcoin continued to struggle with resistance at $38,200, which prompted traders to rotate into altcoins, sparking a mini alt season, the first of this bull market cycle.

The Securities and Exchange Commission (SEC) delayed another spot Bitcoin ETF decision, pushing the application from Franklin Templeton into January – but that did little to stop the speculation that we are mere weeks away from the first such product being approved.

Evidence that institutions are wading deeper into cryptocurrencies was found in the latest digital asset fund flows, which showed that the total assets under management (AuM) of all listed crypto products increased by $346 million during the week ending Nov. 24. Last week marked the ninth consecutive week of inflows and the largest weekly increase since the bull market in late 2021, and brought the total AuM for listed products to $45.3 billion, the highest level in over one and a half years.

Conflicting messages from Fed governors led to a spike in volatility for Bitcoin as traders continued to digest last week's plea deal by former Binance CEO Changpeng Zhao, who has been ordered to remain in the U.S. until his sentencing hearing on Feb. 23, 2024. After hitting a low of $36,720 on Monday, Bitcoin reversed course and hit a weekly high of $38,485 on Wednesday in a failed attempt to break above resistance at $38,200. BTC slid lower from there and closed the Thursday daily candle at $37,733.

At the time of writing, the total cryptocurrency market cap stands at $1.43 trillion, an increase of 0.7% over the past week. The DeFi market cap currently stands at $66.2 billion with a 24-hour trading volume of $5.18 billion, which is 11.8% of the total crypto market volume.

Crypto News

Moon Mission – Dogecoin (DOGE) experienced a bout of bullish momentum after the CEO of Geometric Energy announced that the DOGE-1 satellite mission, a CubeSat mission that has been entirely funded through DOGE donations from members of the Dogecoin community, received approval for the DOGE-1 X-Band from the National Telecommunications and Information Administration (NTIA), advancing the mission one step closer to launch. Once fully approved, the satellite will be launched as part of the payload on a SpaceX Falcon 9 rocket and will be used to collect lunar-spatial intelligence using onboard sensors and a camera. Once in lunar orbit, the satellite will explore the Moon and display images and digital art on a small screen on the lunar orbiter that will be broadcast back to Earth.

Uranium Goes DeFi – Uranium3o8 ($U), the world’s first digital token backed by physical uranium, now has a liquidity pool on the Uniswap decentralized exchange, creating the first-ever spot market for buying and selling exposure to uranium. This will enable qualified entities to purchase and take delivery of the valuable commodity utilizing DeFi for the first time. The uranium backing the token is being sourced by Madison Metals, a publicly traded mining firm with operations in Namibia and Canada. Each $U token represents one pound of physical uranium. In order to take physical delivery of the uranium, token holders will need to meet strict regulatory requirements, hold a minimum of 20,000 $U tokens (representing 20,000 pounds of uranium), and be able to prove to Madison Metals that they are qualified under local laws and regulations to receive it.

Digital Yuan Rising – Multiple large multinational banks, including Standard Chartered, HSBC, Hang Seng Bank, and Taiwanese bank Fubon Bank, have announced that they will begin participating in trials for the digital yuan, China’s central bank digital currency (CBDC). Customers at the banks will now be able to conduct transactions using the e-CNY, either through the bank's mobile applications or by connecting their debit cards to the official e-CNY app to redeem digital renminbi. Clients at all four banks will now be able to transfer and withdraw digital yuan. The banks will also be participating in a pilot testing program to explore the use of the digital yuan in cross-border merchant payments, trade financing, and supply chain financing.

And in the World of Legal Developments

Disgruntled Fans – Pro-soccer star Cristiano Ronaldo has been named in a class-action lawsuit by plaintiffs who claim they suffered losses from his promotion of the crypto exchange Binance. According to the filing, Ronaldo “promoted, assisted in, and/or actively participated in the offer and sale of unregistered securities in coordination with Binance” after he signed a multi-year partnership deal with the exchange in mid-2022 to promote a series of his own nonfungible tokens (NFTs). The complaint alleges that Ronaldo was a key part of Binance’s growing popularity due to his influence and reach, and claimed users who signed up for Ronaldo’s NFTs were more likely to use Binance for other purposes, such as investing in what they claim are unregistered securities, including Binance’s BNB token and crypto yield programs. The plaintiffs are seeking damages of “a sum exceeding” $1 billion.

Crypto Taxes – His Majesty’s Revenue and Customs (HMRC), the tax authority in the U.K., has instructed crypto users in the country to declare and pay their taxes on digital assets within a strict timeframe or face the consequences. The guidance, which was published on Wednesday, provided UK citizens with a clear warning: “If you do not contact us to declare your unpaid tax, you could be liable to additional interest and penalties.” HMRC said the amount of time users have to pay outstanding taxes will depend on why they didn’t pay earlier, and gave taxpayers three options to choose from: confess that they didn't take enough care in paying taxes, evaded paying deliberately, or intended to pay but somehow failed. The latter group will have to pay for the four previous years, while less careful crypto traders have to pay for the last six years, and deliberate tax evaders are liable for taxes on all crypto stored for up to the previous 20 years.

Repayment Deal – Bankrupt crypto lender Genesis has struck a deal with its parent company, Digital Currency Group (DCG), that will see DCG pay its outstanding $324.5 million in loans by April 2024 in an effort to end an ongoing lawsuit aimed at clawing back $620 million in repayments from DCG. The deal would see DCG pay $275 million to Genesis in three installments, partially in U.S. dollars and bitcoin, due by April. The filing includes a stipulation that Genesis will be allowed to follow up on any unpaid amounts. Genesis said the repayment deal will provide it with “immediate significant and near-term benefits” and avoid the “risk, expense, and diversion of resources that would be required by litigation.” The deal will serve as part of Genesis’ plans to pay back creditors, who will vote on the plan before it is sent to Judge Sean Lean for a decision, who will take the wishes of creditors into consideration.

Related News

Philippines issues warning to citizens about using Binance

Binance will end support for BUSD stablecoin in December

Esports Giant Team Liquid Reveals Collab With NFT Game Illuvium

Bitcoin exchange supply shrinks, setting the stage for a liquidity-driven rally

Bankruptcy court says FTX debtors can start selling assets including Grayscale units

ISSUE #69

Market Overview

Cryptocurrency bull markets are known for their volatility, and the current cycle is living up to that reputation as Bitcoin’s price chopped between $35,600 and $38,000 over the past week, albeit with an upward trend.

The source of the volatility was a series of positive and (perceived) negative developments, including the election of a pro-Bitcoin President in Argentina, and a plea deal by Changpeng Zhao (CZ), the now former CEO of Binance, that included a $4.3 million dollar fine for the world’s largest cryptocurrency exchange.

Financial markets, including the crypto market, have also benefited from a fresh round of data that shows inflation continues to moderate. This prompted traders to re-enter the markets as they now think the Federal Reserve is done raising interest rates. despite the minutes from October’s FOMC meeting showing that the Fed board members remain open to additional rate hikes. The CME FedWatch tool now gives a 26.5% chance that the Fed will announce the first rate cut in March 2024.

After trading near $36,500 over the weekend, Bitcoin started to climb higher on Sunday evening after Javier Melie became the president-elect of Argentina. It was rejected at $38,000, and then tumbled lower on Tuesday after the plea deal by CZ was announced, hitting a low of $35,640 in the early hours of Wednesday. From there, bulls made another charge at $38,000 resistance, but that fizzled out, and BTC closed the Thursday daily candle at $37,310.

At the time of writing, the total cryptocurrency market cap stands at $1.42 trillion, an increase of 1.4% over the past week. The DeFi market cap currently stands at $64.7 billion with a 24-hour trading volume of $4.44 billion, which is 11.4% of the total crypto market volume.

Crypto News

Bitcoin-Friendly – Javier Milei, Argentina’s Bitcoin-friendly presidential candidate, won the country’s run-off election on Sunday after securing more than 55% of the votes cast over his opponent Sergio Massa, and will officially take office on Dec. 10. Milei’s victory is notable in that he is an outspoken critic of the central banking system – calling it a scam and a “mechanism by which politicians cheat the good people with inflationary tax,” – and holds a positive view of Bitcoin as a way to return monetary power to the people. While the libertarian economist is the anti-establishment choice and holds a decidedly positive view of BTC, he has not signaled any intention to make Bitcoin legal tender in the country. Instead, he has indicated a desire to ditch his nation’s peso and adopt the U.S. dollar as the national currency.

Ironing Out the Details – A memo dated Nov. 20 indicates that representatives from BlackRock and Nasdaq met with the SEC to discuss the proposed rule allowing the listing of a spot Bitcoin. The memo shows that BlackRock provided a presentation detailing how the firm could use an in-kind or in-cash redemption model for its iShares Bitcoin Trust. It’s unclear how SEC officials responded to the two proposed models or if they intend to approve a spot BTC ETF after numerous delays and rejections. BlackRock first applied for a spot BTC ETF in June and is now one of many firms with similar applications in the SEC pipeline awaiting a response, including Fidelity, WisdomTree, Invesco Galaxy, Valkyrie, VanEck and Bitwise.

Class-Action Pushback – A class action lawsuit has been filed against Apple, with the plaintiffs claiming the tech giant has conspired to limit peer-to-peer (P2P) payment options on its devices and block crypto technology from iOS payments apps. The complaint was filed on Nov. 17 in a California District Court, and alleges that Apple entered into anti-competitive agreements with PayPal’s Venmo and Block’s Cash App to restrict the use of decentralized cryptocurrency technology in payment apps, which caused users to pay “rapidly inflating prices.” They said Apple uses restraints to “exercise unfettered control over every app installed and run on iPhones and iPads,” and said Apple forces new-to-market iOS P2P payment apps to bar crypto “as a condition for entry.” They seek to recover for excessive fees and overcharging and injunctive relief barring the firm from continuing the practice.

And in the World of Cryptocurrency Exchanges

End of an Era – Changpeng Zhao (CZ), the CEO of Binance, the world’s largest cryptocurrency exchange, has agreed to a plead deal with the U.S. Department of Justice that will see him plead guilty to a criminal charge, step down as CEO, and pay fines totaling $4.3 billion. An unsealed indictment from the DOJ shows that CZ and Binance faced charges of operating an unlicensed money-transmitting business, violating the International Emergency Economic Powers Act, and the failure to maintain an effective anti-money laundering program. Binance has also been ordered to make a "complete exit" from the U.S. market. Binance has named its head of regional markets outside of the United States, Richard Teng, as its new CEO.

In Full Force – The U.S. SEC filed a lawsuit against the Kraken cryptocurrency exchange, alleging it commingled customer funds and failed to register with the regulator as a securities exchange, broker, dealer, and clearing agency. In the filing, the SEC alleged Kraken’s business practices and “deficient” internal controls led to the commingling of up to $33 billion worth of customer assets with its own, which resulted in a “significant risk of loss” for its clients. The complaint claimed Kraken paid for operational expenses directly from accounts containing customer assets, citing the exchange’s independent auditor. As part of the filing, the SEC listed 16 cryptocurrencies it considered securities, including Cardano’s ADA, Algorand, Polygon, and Solana.

The Seven-Year Saga – Creditors of the long-defunct Mt. Gox Bitcoin exchange received an update on the status of their claim repayments from the 2014 hack that saw 850,000 BTC stolen from the exchange. Nobuaki Kobayashi, the trustee overseeing the Mt. Gox estate, began sending out emails to rehabilitation creditors regarding the commencement of repayments on Wednesday, saying that he expects to start the first repayments to creditors in cash in 2023 and will continue the repayments in 2024. According to data from the Mt. Gox balance bot on X (formerly Twitter), the Mt. Gox trustee holds 135,890 BTC ($5 billion) on all known addresses, and an additional 3,795 BTC ($130 million) are held on unknown addresses.

Related News

KyberSwap DEX exploited for $46 million, TVL tanks 68%

CZ an ‘unacceptable risk of flight,’ should stay in US: DOJ

Changpeng Zhao names Richard Teng as new Binance CEO

Court denies Sam Bankman-Fried's latest request for release

'No Reason' for SEC to Deny Bitcoin ETF, Says Hester Peirce

Genesis Sues Gemini to Recover 'Preferential Transfers' Worth $689M

ISSUE #68

Market Overview

It was a volatile yet positive week for the cryptocurrency market as Bitcoin (BTC) climbed back above $37,000 on multiple occasions, with bulls now looking to flip resistance at $38,000 into support as the next stage in their journey towards a new all-time high.

Developments related to a spot Bitcoin ETF continue to be the primary driving force behind the momentum, with many speculating that all the ETF applications before the SEC would be approved this week. The SEC can only approve an application outside of public comment periods, and there was a brief window open until Nov. 17 where all the spot BTC ETF applications were in between comment periods, giving the SEC the opportunity to approve them in one fell swoop so as to not give any application first mover advantage.

Macro factors also had an effect on crypto prices, with the latest Consumer Price Index and Producer Price Index reports showing that inflation continues to moderate. Investors took the lower inflation reads as a sign that the Federal Reserve would continue to hold off on additional interest rate hikes, and the consensus is now that the central bank will actually be forced to lower rates as soon as May in an effort to help support the economy.

After briefly spiking near $38,000 last week, Bitcoin trended lower as traders booked profits, and plunged to a low of $34,780 on Tuesday amid chatter that a retest of $31,000 was inevitable. The outlook changed on Wednesday when a midday rally pushed Bitcoin to a high of $37,965, where bulls ran into a strong bear wall of resistance. On Thursday, BTC corrected lower again, bottoming out at $35,517, and closing the daily candle at $36,165.

At the time of writing, the total cryptocurrency market cap stands at $1.4 trillion, a decrease of 0.7% over the past week. The DeFi market cap currently stands at $64.5 billion with a 24-hour trading volume of $7.23 billion, which is 10.7% of the total crypto market volume.

Crypto News

Institutional Blockchain Rising – JPMorgan said their JPM Coin could be handling as much as $10 billion in daily transactions in the next year or two as blockchain adoption continues to roll out around the globe. A representative from the bank said they are expecting at least a 5 to 10-fold increase in transactions in the years ahead, greatly expanding their current count of $1 billion in transactions daily. JPM Coin enables wholesale clients to make dollar and euro-denominated payments through a private blockchain network, and is one of the few examples of a live blockchain application by a large bank, but remains a small fraction of the $10 trillion in US dollar transactions moved by JPMorgan on a daily basis.

ETF Fakeout – Someone filed a fake listing with the State of Delaware’s Division of Corporations on Monday that made it look as though BlackRock had registered an “iShares XRP Trust,” which helped provide a boost to the market and caused a brief 12% pike in the price of XRP. BlackRock was quick to deny making such a filing, and many analysts were skeptical from the start, so the rally quickly faded, and XRP price has drifted lower ever since. On Tuesday, the Delaware Department of State said the matter would be referred to the state authorities to investigate, and those responsible could be held liable for fraud since they used BlackRock managing director Daniel Schwieger’s name to register the fake trust.

Decentralizing DeFi – Microsoft, Tencent, and 16 other Web2 giants have partnered with Consensys in an effort to increase decentralization on the Infura network, which is the key point of access to Ethereum for much of the decentralized finance (DeFi) sector. The Infura network serves a vital role in that it helps prevent outages of the Web3 services that leverage it, including the wallet service MetaMask. DIN is currently scheduled to launch in Q4 and will offer a solution to the centralization for Infura, which is currently controlled by Consensys, meaning there remains a single point of failure. One of the first major features to be offered in the DIN is “failover support” for the Ethereum and Polygon networks, which means that the traffic on those networks can be re-routed to one or multiple DIN partners during an outage, guaranteeing higher uptime rates in the long run.

And in the World of Launches and Filings…

Ether Joins the Party – BlackRock, the world’s largest asset manager, filed an application for a spot Ether ETF, which sent the price of the second-ranked cryptocurrency by market cap back above $2,100 for the first time since April. The filing added to the building ETF hype that kicked off when the firm filed its spot BTC ETF application in June, and the SEC now has nearly 20 crypto-related ETF applications that it needs to make a determination on. Along with BlackRock, ARK 21Shares, VanEck, Hasdex, and Invesco have also filed spot ETH ETF applications with the SEC, and Grayscale Investments has moved to convert its Ethereum Trust into a spot Ether fund. There have also been multiple spot Ether ETF applications filed, with some already approved and trading on the markets.

Can’t Beat Them? Join Them – Economist Nouriel Roubini, a well-known crypto skeptic, appears to have joined the “blockchain, not Bitcoin club” as his asset management firm, Atlas Capital, has announced that it will be launching its own crypto token, the Atlas Climate Token (ACT). ACT is designed to be a blockchain-based stablecoin that will be pegged to a portfolio of liquid real-world assets, including climate-resilient REITs, strategic commodities, inflation-hedged sovereign bonds, and gold. To determine the price of each ACT, the Atlas Index will utilize advanced artificial intelligence, machine learning, and data processing tools to “track and measure the price performance and volatility of liquid, stable, and negatively correlated legacy assets that have formed the foundation of the US Dollar (Gold, Real Estate/REITs, US Treasuries).” The weighting of the token will be 55% U.S. Treasuries and Treasury Inflation-Protected Securities (TIPS), 20% gold, and 25% North American REITs.

NFTs Enter the Big Time – Disney announced a new partnership with blockchain and metaverse firm Dapper Labs to launch an NFT platform named Disney Pinnacle, which will tokenize Disney's classic cartoon characters going back a century, along with well-known characters from Pixar and the Star Wars universe. Disney plans to present the tokens as collectible and tradable digital pins on the NFT marketplace, allowing fans from around the world to collect the pins on their phones and securely trade them with others worldwide. Dapper Labs’ layer-1 blockchain Flow (FLOW) will host the marketplace, which Disney plans to launch later this year on the Apple App Store for iOS, the Google Play Store for Android, and on the web.

Related News

CBDCs can ‘replace cash,’ IMF says

Manny Pacquiao Turns to Shiba Inu to Help His Foundation

Grayscale ETH futures ETF a ‘trojan horse’ for spot Ethereum ETF: Analyst

House Financial Services panel at odds on crypto's part in financing terrorism

Even after a 550% increase in 2023, this altcoin still has 57x potential - VanEck

SEC Delays Decision on HashDex Bitcoin Spot ETF Application, Grayscale Ether Futures Filing

ISSUE #65

Market Overview

Bull market momentum continued to pick up steam over the past week as a surge in open interest for Bitcoin led to a short squeeze that pushed the top crypto to a fresh 2023 high near $38,000, with bulls now strategizing how they can flip resistance at $40,000 into support.

Bitcoin’s struggles to overcome the solid wall of resistance in this zone prompted traders to rotate into altcoins, leading many on social media to declare the first “altcoin season” in the new bull market cycle.

Some of the biggest gainers in recent weeks include blue chip cryptocurrencies like Solana (SOL) and ChainLink (LINK), while multiple low-cap tokens in the gaming sector have seen double-digit increases as traders moved to position themselves ahead of a potentially year-long (albeit volatile) uptrend.

After hitting a low near $34,100 late last Friday, Bitcoin clawed its way back up to hit a high of $38,000 on Thursday, before profit-taking led to a pullback, resulting in a Thursday close of the daily candle at $36,725.

At the time of writing, the total cryptocurrency market cap stands at $1.41 trillion, an increase of 8.5% over the past week. The DeFi market cap currently stands at $58.1 billion with a 24-hour trading volume of $8.67 billion, which is 9.1% of the total crypto market volume.

Crypto News

Guilty – The five-week criminal trial of former FTX CEO Sam Bankman-Fried (SBF) came to an end last Thursday as the jury found him guilty on all seven counts in question, setting SBF up for a maximum sentence of 115 years in prison. Up next comes the sentencing hearing, where Judge Lewis Kaplan will decide on the appropriate sentence for SBF. The hearing has been tentatively scheduled for March 28.

Speedy Judgment – Dual court filings by the Securities and Exchange Commission (SEC) and the defense team for Terraform Labs founder Do Kwon show that both parties involved in the lawsuit have requested that the judge presiding over the case make a summary judgment on the claims without a full trial. Both motions for summary judgment are now in the hands of the presiding judge and will be ruled on in the near future.

Adoption Rising – HSBC announced plans to launch an institutional custody platform for tokenized securities via a partnership with Ripple-owned tech firm Metaco. The bank expects to roll out the service in 2024 as a complement to its digital asset issuance platform – HSBC Orion. HSBC emphasized that the new digital asset custody platform will only cover security tokens and will not support cryptocurrencies like Bitcoin or stablecoins like USDT.

And in the World of…

Going Pubic – Circle Internet Financial, the company behind the USDC stablecoin, is reportedly considering launching an initial public offering (IPO) in early 2024, according to anonymous sources familiar with the matter. They said the firm is currently in talks with their advisers about the potential of going public, but there has been no official announcement as deliberations are ongoing.

Expanding Access – Hong Kong is currently assessing whether to allow retail investors to access crypto-related ETFs, according to Julia Leung, CEO of the Hong Kong Securities and Futures Commission (SFC). She said the city is weighing retail-investor access to such spot ETFs “as long as new risks are addressed and regulatory concerns are met.” The SFC also recently updated its regulatory guidelines to clear the way for retail investors to access tokenized products.

CBDC Success – Mastercard announced the successful completion of a digital Hong Kong Dollar (e-HKD) pilot program that demonstrated the efficacy of the company’s Multi-Token Network (MTN) solution to settle Web3 transactions involving dApps and digital assets, such as NFTs. The pilot also showcased the potential for seamless funding and settlement in and out of Web3 marketplaces via a retail CBDC, such as e-HKD.

Related News

Tom Emmer sneaks crypto provision into House budget bill

Spot trading volume increases after multiple months of decline

Illuvium Ethereum Token Surges After Epic Games Store Listing

Chainlink (LINK) pumps 26% in 6 days — Is there room for more?

Bitcoin ‘short squeeze’ sends BTC price to $35.9K as OI stays elevated

Bitcoin Fees Soar Nearly 1,000% Since August as Ordinals Are Back in Vogue

ISSUE #64

13 October 2023

Market Overview

The cryptocurrency market trended down over the past week as an uptick in geopolitical uncertainty brought on by Hamas’ attack on Israel added to the growing list of troubles already plaguing the global financial system.

Focusing on developments in the U.S., the latest wholesale inflation data came in hotter than expected at 2.2% versus the predicted 2%, while the minutes from the September Fed meeting showed that a majority of Fed representatives see another interest rate as “likely to be appropriate.” This has raised the odds in the eyes of investors that there will be at least one more hike in 2023, which exerted negative pressure on risk assets.

The trial for former FTX CEO Sam Bankman-Fried (SBF) got underway, with the testimony in the first week being dominated by SBF’s former friends and business associates, who detailed how the once lauded CEO designed a system where an unlimited amount of customer funds could be transferred to Alameda Research for the company to trade with as it wished. Caroline Ellison, SBF’s one-time romantic partner and CEO of Alameda Research, said she was relieved when FTX collapsed as she “didn’t have to lie anymore.”

Bitcoin’s price action began to trend down on Sunday following the surprise attack by Hamas on Israel and limped lower throughout the week. After the wholesale inflation data released on Wednesday, the top crypto briefly dropped to $26,525, its lowest level since Sept. 28. At the close of the daily candle on Thursday, BTC traded at $26,750.

At the time of writing, the total cryptocurrency market cap stands at $1.05 trillion, a decline of 2.78% over the past week. The DeFi market cap currently stands at $41.8 billion with a 24-hour trading volume of $1.8 billion, which is 7.8% of the total crypto market volume.

Crypto News

Solana Rising - Solana continues to gain favor with investors while Ethereum’s price limps lower as the latest digital asset fund flows report from CoinShares showed that SOL-based products saw the second largest inflows of all funds behind Bitcoin, with $23.9 million flowing into these exchange-traded products the week ending Oct. 6. It was the token’s largest week of inflows since March 2022. Analysts said the project continues “to assert itself as the altcoin of choice” despite the recent launch of multiple Ether futures products, which have thus far seen a muted level of activity. Last week was the second consecutive week of positive inflows for all digital asset investment products, with Bitcoin seeing inflows of $42.7 million.

Solana Rising - Solana continues to gain favor with investors while Ethereum’s price limps lower as the latest digital asset fund flows report from CoinShares showed that SOL-based products saw the second largest inflows of all funds behind Bitcoin, with $23.9 million flowing into these exchange-traded products the week ending Oct. 6. It was the token’s largest week of inflows since March 2022. Analysts said the project continues “to assert itself as the altcoin of choice” despite the recent launch of multiple Ether futures products, which have thus far seen a muted level of activity. Last week was the second consecutive week of positive inflows for all digital asset investment products, with Bitcoin seeing inflows of $42.7 million.

Frozen Funds - Police in Israel moved quickly to freeze multiple cryptocurrency accounts on Binance determined to be associated with Hamas in response to the militant organization's surprise attack over the weekend. Hamas used the accounts to raise donations via social media networks, but with the assistance of Binance, the funds held in those accounts will now be redirected to Israel’s state treasury to be used towards rebuilding efforts. A review of Israeli government seizure orders and blockchain analytics reports shows that in the year leading up to the attack, wallets connected to Hamas received $41 million in crypto donations, while the Palestinian Islamic Jihad and its Lebanese ally Hezbollah received $93 million.

Currency Hedge - Jefferies released a note to investors calling Bitcoin a “critical hedge” against the potential for monetary policy that reduces the value of currency, putting the top crypto in the same bag as gold in providing effective protection against policies that eroded the purchasing power of the U.S. dollar and other fiat currencies over time. The firm said that while investors have “effectively given up” on the U.S. recession forecast, the data still indicates that a downturn is coming, and efforts to tighten monetary conditions will suffer a larger lag than usual this cycle due to an explosion of money supply growth dating back to 2020. Jefferies went on to recommend that U.S. dollar-based long-term global investors, including pension funds, allocate 10% of their funds to Bitcoin, saying investments in both BTC and gold should be regarded by investors as insurance rather than short-term trades.

And in the World of Product Launches and Adoption…

DeFi Debit Card - Wirex, a firm that specializes in digital payment solutions, announced the launch of W-Pay, a platform that connects decentralized applications (dApps), non-custodial wallets, and traditional payment infrastructures to allow firms to issue non-custodial crypto debit cards. Up to this point, debit cards that allow crypto holders to spend their tokens have required them to deposit their coins on centralized platforms, such as Coinbase, that exchange the underlying assets at the time of purchase and transfer the fiat money to the receiver. W-Pay allows cardholders to maintain control of their assets, a key part of the ethos of using cryptocurrencies and “being your own bank” through self-custody. The new platform uses ZK-powered technology to offer fast, secure payments, and offers EVM compatibility and account abstraction, helping to simplify the user experience.

Tokenized Collateral - JPMorgan announced the launch of its new Tokenized Collateral Network (TCN), a blockchain-based tokenization application that will allow investors to better utilize assets as collateral and transfer collateral ownership without needing to move assets in the underlying ledgers. The new platform has already been successfully trialed by BlackRock, which used it to tokenize shares of one of its money market funds and transfer them to Barclays as collateral for an over-the-counter derivatives trade between the two institutions. The system utilizes JPMorgan's in-house blockchain network Onyx to conduct instantaneous transactions, allowing clients to access intraday liquidity through a secured repo transaction using tokenized collateral instead of relying on expensive unsecured credit lines. The ultimate goal is for the application to allow clients to use other assets, including equities and fixed income, as collateral.

Pay with Gold - The Reserve Bank of Zimbabwe (RBZ) announced that its Zimbabwe Gold (ZiG) gold-backed digital token is now officially endorsed as a payment method in the country and can be used to complete domestic transactions. The value of ZiG is pegged to the value of the country’s physical Mosi-oa-Tunya gold coin and will be revalued in line with the international gold price. Banks in the country will maintain dedicated ZiG accounts and facilitate transactions in ZiG in the same manner as they do with transactions in local and foreign currencies. External auditors have been hired by the RBZ to validate that there is enough gold in the bank’s reserves to back all issued ZiG tokens. The intent behind releasing both the physical and digital gold tokens is to persuade local investors to put their money into a national asset as opposed to U.S. dollars amid triple-digit inflation.

Related News

Amazon and Immutable team up to advance Web3 gaming

Democratic senators tell IRS to speed up crypto tax reporting rules

Yield Generating Stablecoin USDR Loses Peg, Plummets to $0.50

Brazil’s Congress puts Binance CEO CZ in crosshairs for indictment

Paul Tudor Jones says he 'likes gold and Bitcoin' as the U.S. heads towards a recession

ISSUE #64

6 October 2023

Market Overview

The chop continued for another week in the crypto market, albeit with an upward drift, as asset prices across the board saw a spike in volatility amid deteriorating global financial conditions and a surging U.S. Dollar.

The week started off hot for both digital and traditional assets as news of a last-minute deal to avert a U.S. government shutdown spread, but the gains were short-lived for most as prices quickly reversed lower in the face of rising Treasury Yields and the DXY.

The U.S. 10-year Treasury yield hit 4.885 on Wednesday, its highest level since August 2007 – when the great financial crisis was really starting to put pressure on banks – while the DXY climbed to 107.351 on Tuesday, its highest level since Nov. 30, 2022. The move higher prompted many traders to exit the market and opt for “risk-free” yields, but dip buyers were waiting to scoop up oversold assets, helping prices to stabilize in trading on Wednesday.

Bitcoin's (BTC) price spiked as news of the debt deal first emerged on Sunday, hitting a weekly high of $28,615 near midday on Monday before profit-taking dropped it down to support at $27,500. Bears attempted to push its price a leg lower from there, but bulls successfully defended those efforts, and BTC closed the Thursday daily candle at $27,407.

At the time of writing, the total cryptocurrency market cap stands at $1.08 trillion, unchanged over the past week. The DeFi market cap currently stands at $43.5 billion with a 24-hour trading volume of $2.72 billion, which is 10.6% of the total crypto market volume.

Crypto News